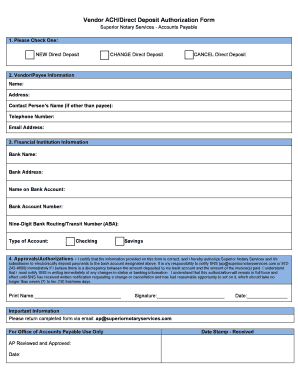

SCCHA Direct Deposit Authorization Form free printable template

Fill out, sign, and share forms from a single PDF platform

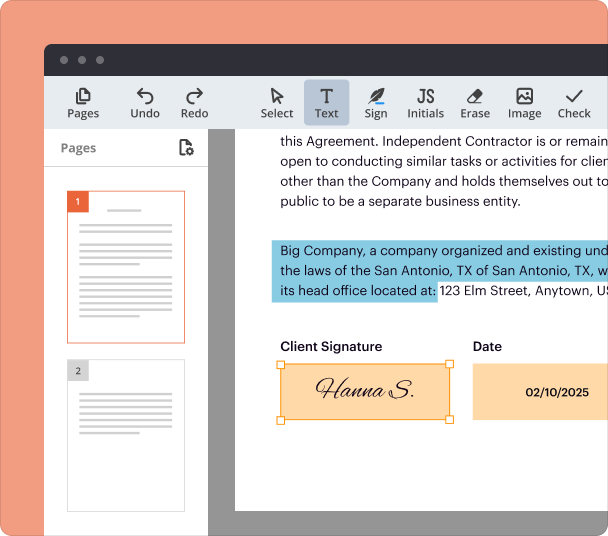

Edit and sign in one place

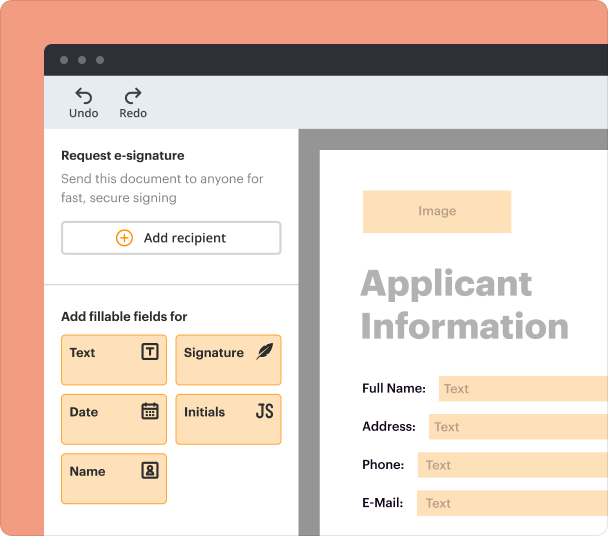

Create professional forms

Simplify data collection

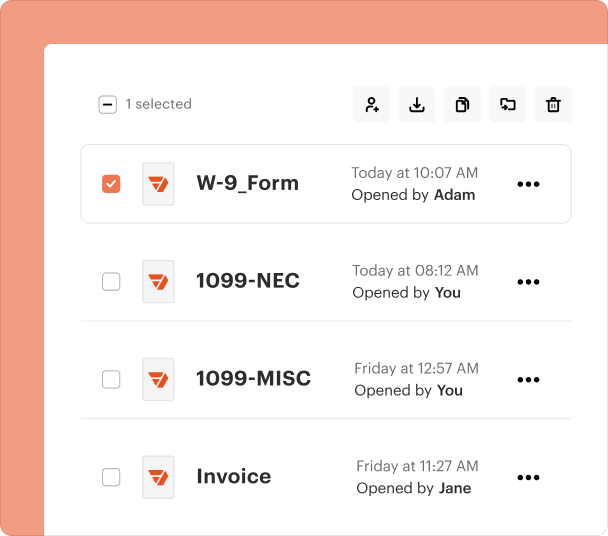

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

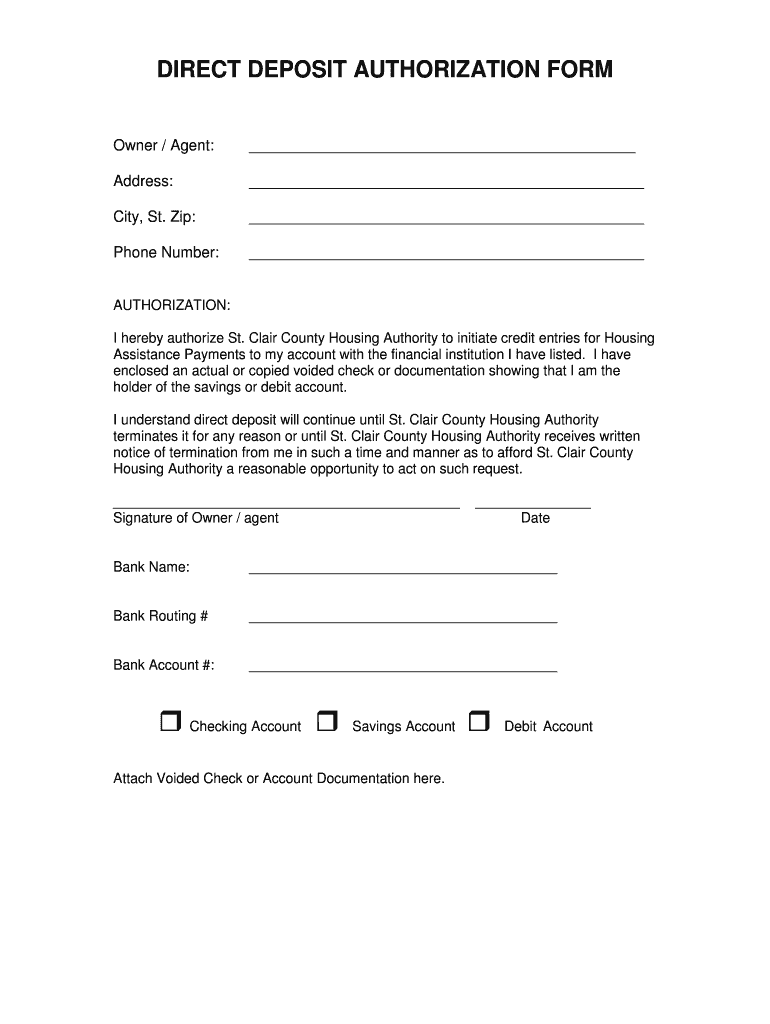

Complete guide to SCCHA direct deposit authorization form

To fill out a SCCHA direct deposit authorization form correctly, gather required documents such as your bank details and personal information. Follow our detailed guide below for step-by-step instructions, benefits, and submission methods.

What is the direct deposit authorization form?

The SCCHA Direct Deposit Authorization Form is a document that authorizes the St. Clair County Housing Authority (SCCHA) to deposit your rental assistance payments directly into your bank account. This process streamlines payments, ensuring you receive your funds on time while minimizing errors that can occur with physical checks.

-

It serves as a formal request to facilitate seamless electronic transfer of housing assistance payments.

-

Landlords and housing providers who wish to receive benefits from SCCHA must fill this out.

-

Direct deposits are faster, more secure, and reduce the need for visits to SCCHA for payment inquiries.

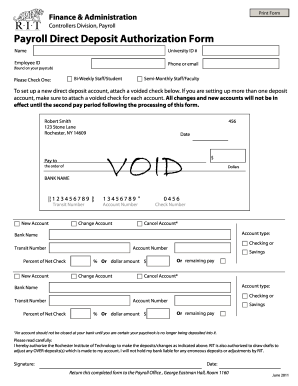

What do need before filling out the form?

Before filling out the SCCHA direct deposit authorization form, it's essential to gather necessary documents. This ensures you provide accurate information, which can expedite your application process.

-

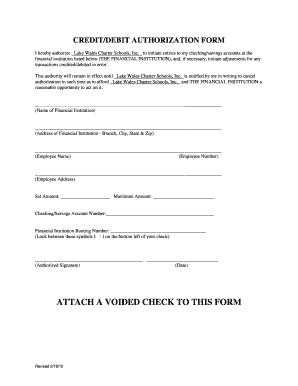

Having a voided check simplifies entering your bank account information.

-

Make sure your SCCHA account is in good standing before proceeding.

-

Know your bank's routing number, account number, and the type of account you have.

How do complete the form?

Filling out the SCCHA direct deposit authorization form requires attention to detail to ensure your information is accurately represented. Below is a step-by-step guide to assist you.

-

Provide your full name and title to establish your identity.

-

Ensure your contact details are current and precisely entered.

-

A good contact number helps facilitate communication regarding your direct deposit.

-

This section is crucial for initiating the direct deposit process and must be signed.

-

An unsigned form will not be processed, so remember to sign and date correctly.

-

Double-check these entries for accuracy to prevent payment delays.

-

This helps SCCHA know how to handle your account appropriately.

What are some tips for accuracy and compliance?

Ensuring your SCCHA direct deposit authorization form is filled out correctly is vital for a smooth payment process. Below are some pointers for maintaining accuracy and compliance.

-

Be careful about typos in bank details or contact information; these can cause delays.

-

Check that all required fields are completed to prevent rejection of your form.

-

Keep your financial information secure and only submit it through approved channels.

How do submit the SCCHA direct deposit authorization form?

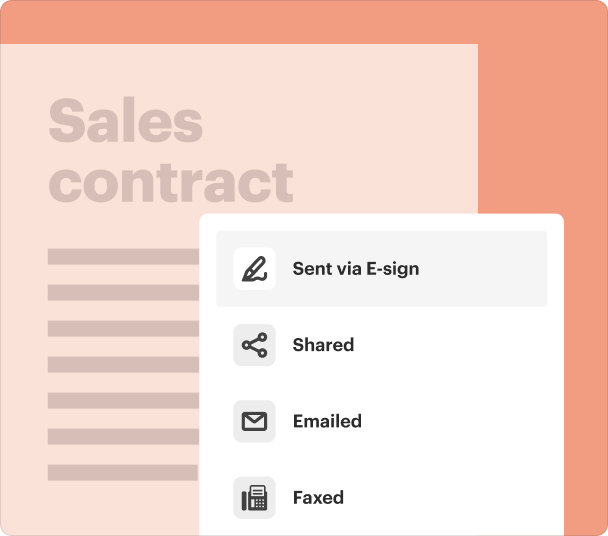

Submitting your completed SCCHA direct deposit authorization form is the final step to start receiving your payments electronically. You can choose from several submission methods.

-

Using the online platform is quicker and allows real-time updates.

-

With pdfFiller, you can easily fill, sign, and submit your forms online without the hassle of printing.

-

Stay informed by checking your submission status directly online.

How do manage my direct deposit after submission?

Once your direct deposit authorization form has been submitted, it's essential to know how to manage it for ongoing accuracy and compliance. Here are the steps to effectively manage your direct deposit.

-

If your banking information changes, complete a new authorization form as soon as possible.

-

Contact SCCHA for guidelines on officially stopping your direct deposit.

-

Reach out to SCCHA’s support if you encounter issues or have questions about your payments.

Frequently Asked Questions about ach form

What if my bank account changes?

If your bank account changes, you must update your direct deposit authorization by submitting a new SCCHA Direct Deposit Authorization Form. Keeping your information current prevents interruptions in your payment schedule.

How long does it take for direct deposit to start?

Typically, direct deposit may take one to two payment cycles before becoming active. It's advisable to keep track of your SCCHA payments during this transition period.

Who to contact for issues or inquiries regarding direct deposit?

For any issues related to your SCCHA direct deposit, you should reach out directly to the SCCHA customer service team or check their Owner Portal for support.

Can I change my account type after submission?

Yes, but you need to submit a new authorization form to change your account type. Make sure to do this promptly to ensure continued service.

Is there any fee associated with direct deposits?

Generally, SCCHA does not charge fees for direct deposits. However, it's advisable to confirm with your bank for any potential fees they might impose.

pdfFiller scores top ratings on review platforms